Towards An East London Fashion District

Foreword

THE STORY OF FASHION IS THE STORY OF TECHNOLOGY. LONDON NEEDS TO ACT NOW TO STAY AT THE CENTRE OF FASHION-TECH, WHICH IS RE-SHAPING THE FASHION INDUSTRY WORLDWIDE.

Technology brought us mass production, took manufacturing offshore and lost London its rag trade. Fifty years on, fashion-tech is bringing us mass personalisation, grounded inartificial intelligence and machine learning. This time, London needs to grab its advantage.

Even now, fashion-tech is weaving wearables into our clothes, alongside haptic feedback and conductive yarn that enables touch interactivity. Garment construction now uses 3D printing and laser-welding. Retail will be among the first industries disrupted by mixed reality. Blockchain will safeguard luxury goods from counterfeiting.

Like hi-tech, fashion-tech is a London story. As this research shows, hundreds of fashion-tech businesses have grown up organically in London. Some of the leading companies in this field are British. It should be no surprise. London is the creative capital of the world, and East London is the heart of the UK’s digital and knowledge economy.

But as the research also suggests, these businesses can only achieve growth with significant support in skills, advocacy, innovation and investment. To deliver this support, we are creating an industry-led partnership which will reinforce this creative strength, giving fashion-tech the boost it needs in the Fashion District, East London.

This is a pivotal moment in London’s story as the world’s capital of fashion. Let’s make London the home of fashion-tech.

PROF. FRANCES CORNER OBE

Head of London College of Fashion

Pro Vice-Chancellor, University of the Arts London

Vision

A VISION FOR AN INDUSTRY LED FASHION CLUSTER

Fashion is the point where society, culture and technology meet most vividly for the woman and man in the street. It is an important business sector and a significant engine of growth for the UK. And now we aim to revive fashion manufacturing as a major force in London, which is already recognised as a world fashion capital for its creative influence.

Up to the 1970s, if you asked a Londoner about fashion manufacturing, she would have mentioned East London. For centuries, fashion manufacturing was a dominant industry here. From the Huguenots on, this was a key way in which recent immigrants contributed to London’s character and economy. The manufacturing base enabled British fashion to be selfsufficient, able to experiment.

Much was lost during the offshoring crisis, but East London’s rich fashion and craft heritage was resilient. High-end fashion manufacturing has returned to growth after decades of decline with a focus on fashion technology, which is expected to disrupt and transform the global fashion industry.

WE WANT TO ACCELERATE THIS GROWTH. WE WANT EAST LONDON TO RECLAIM ITS PLACE AS A CENTRE FOR FASHION INNOVATION, DESIGN, MANUFACTURE AND RETAIL, AND BECOME THE FASHION-TECH CAPITAL OF THE WORLD.

Despite numerous structural issues, our research suggests this vision is realistic and achievable. East London is already home to 23 per cent of the capital’s fashion enterprises and employment, and it drives growth in fashion design, retail and manufacturing.

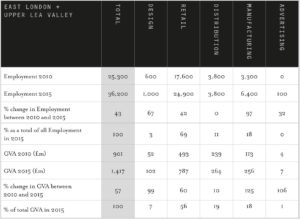

• Fashion in East London and the Upper Lea Valley now contributes £1.4 billion in GVA – up by £500m (57 per cent) between 2010 and 2015.

• At the start of 2016, 36,200 people were directly employed in fashion retail, design, manufacture, distribution and advertising – an increase of 10,900 jobs since 2010.

TO ACHIEVE THIS VISION, WE ARE CREATING AN INDUSTRY-LED CLUSTER CALLED THE FASHION DISTRICT TO ACCELERATE FASHION-TECH BUSINESSES.

This will add to our existing creative strengths, repositioning London’s fashion sector as a creatively-led digital manufacturing centre. The cluster will be at the heart of the UK’s knowledge economy, focusing on our strengths in generating intellectual property. It will be a destination for investment in UK fashion business. It will incubate new companies, business models and support for innovation in products and services. It will attract global talent, catalyse production corridors across East London and the Upper Lea Valley, and drive growth in regional textiles manufacturing. Here we summarise the findings of independent research into East London’s fashion potential, and we outline how the Fashion District can make a difference.

SUPPORT FOR THE FASHION DISTRICT

The plan is backed by the Greater London Authority and a coalition of major players in London and UK fashion. These include UAL, UK Fashion and Textiles, British Fashion Council, LLDC, Poplar HARCA, The Trampery, Fashion Enter, Newham College and Westfield. The plan is being developed in consultation with the London Boroughs across East London.

WHY THE FASHION SECTOR

The role of creative industries in driving economic growth is well documented. Within that, fashion is a huge, export-driven sector of regional, national and global importance.

• The direct value of the UK fashion industry to the UK economy is estimated at £28.1 billion, twice that of the automotive or chemicals industries.

• Fashion’s total contribution to GDP is greater than £50 billion – equivalent to 2.7% of UK GDP.

• The sector represents 22.2% of all retail GVA and 2.5% of UK manufacturing output.

• The global fashion industry is worth an estimated US$2.4 trillion to US$3 trillion per annum.

THE VALUE OF THE UK FASHION INDUSTRY IS ESTIMATED AT £28 BILLION, TWICE THAT OF THE AUTOMOTIVE OR CHEMICALS INDUSTRIES.

STRUCTURAL ISSUES

We need to address a range of barriers to increase labour supply and reduce input costs. If not, the ratchet effect of loss of capacity, opportunity and reputation would threaten London’s status as a world fashion city.

East London faces a range of structural issues around access to workspace, finance, skills and export:

• Property – the success of other sectors of the knowledge economy has exacerbated the conflict between increasing housing supply and safeguarding business premises. Existing fashion businesses in East London risk being displaced, so their industry bodies are fighting hard to identify new premises accessible to both customers and employees.

• Skills – if businesses are forced to move, skilled local people will lose their jobs. This will hurt ordinary Londoners and deprive high-end manufacturers of specialist skills. The workforce is hard to replace through training and recruitment because of an outdated image of ‘sweatshop’ labour among young people. Fashion manufacturers lack digital skills, from basic software to digital fabrication methods, and many designers lack garment technology skills.

• Access to finance – investment in creativity and innovation is hard to find. Fashion designers suffer cash-flow problems because they lack access to finance, particularly for new collections. And tech investors are unaware of the potential for fashion-tech because it is an emerging area.

• Brexit – brings opportunities for this export-led sector, and it threatens freedom of movement for students and skilled workers coming from EU countries. Fashion operates in global markets affected by geopolitical volatility. Tariff and nontariff barriers to international trade would impose real constraint.

WHAT WILL THE FASHION DISTRICT DO?

To address these issues, the Fashion District will work with sector partners to speed up investment in skills, workspace and R&D, and clear barriers to growth. It will be based in a world-class hub for fashion education, design, business and technological innovation within the educational, technology and cultural institutions at East Bank on Stratford Waterfront. This will transform the competitiveness and productivity of the fashion and textile industry in London and across the UK.

INDUSTRIAL STRATEGY OPPORTUNITY

BEIS’s Modern Industrial Strategy offers place-specific ‘sector deals’ (funds for skills and research) available where an industry can come together, demonstrate it has a clear understanding of the issues and problems facing it and devise a clear set of solutions. This is an opportunity for fashion. There is no better sectoral or industry candidate in which to undertake a value chain analysis and propose innovations across that chain.

Trends

TECHNOLOGY, SUPPLY CHAIN AND CONSUMER BEHAVIOUR

Global fashion trends are not limited to design. Technology, supply chain management and changing consumer behaviour shape global markets.

CONVERGING PLATFORMS, DIVERSE AUDIENCES

Fashion is now part of the experience economy. Consumers expect online and high street retail environments to reflect one another, and to see new product at each visit. The industry has responded with a much faster cycle of new product development and launches. This requires the supply chain to respond more quickly and accurately to consumer demand, giving a competitive advantage to local manufacturing.

DISRUPTION

Digital technologies reshape markets and value chains for fashion content and information, enabling innovative businesses to create value-added services, applications and products. ICT helps bring to market services, applications and products across all sectors through production, distribution and e-commerce.

DIGITAL MANUFACTURING

While mass manufacturing is not feasible in London, digital manufacturing would re-cast London’s fashion sector as a globally significant digital manufacturing cluster. This would increase high-value employment and drive inward investment.

ETHICAL AND SUSTAINABLE FASHION

Concerns about the sustainability and work conditions associated with ‘fast fashion’ have made consumers more focused on where and how their clothes are made.

CONSUMERS EXPECT ONLINE AND HIGH STREET RETAIL ENVIRONMENTS TO REFLECT ONE ANOTHER

Strengths

STRENGTHS OF THE FASHION SECTOR IN EAST LONDON AND THE UPPER LEA VALLEY.

Our review of employment and output statistics supports anecdotal evidence of growth in the fashion sector in East London. Led by retail employment at Westfield, the emergence of Hackney as a design powerhouse and re-emergence and reshoring of value-added manufacturing across East London and Upper Lea Valley.

These findings confirm the urgent need to build capacity and promote innovation and resilience across the whole value chain.

As it faces disruption, London must harness fashion-tech to a range of new products and experiences. We need to increase absorptive capacity for innovation across all parts of the fashion supply chain to sustain a productive, high-growth fashion sector. Physical clustering of fashion design, production and other service providers amplifies signals from the market and helps all members of the cluster become more productive, more competitive, and more creative.

HIGH GROWTH SECTOR

GVA from fashion in this sub-region grew by 57% (including inflation) between 2010 and 2015, against 29% for the sector in London as a whole.

SCALE

There are 36,200 people in full-time employment in East London fashion in 12,000 businesses – an increase of 10,900 jobs and 1,800 companies between 2010 and 2015.

RESILIENCE

Fashion in East London has demonstrated resilience in its growth during a period of turbulence in its external market environment – in particular, in the re-emergence of addedvalue production for high-end fashion products.

Hackney Fashion Hub has helped stimulate awareness of the fashion sector in East London amongst international consumers through its mix of global brands (Burberry, Nike) and independent designers.

EAST LONDON IS GROWING IN IMPORTANCE AS A LOCATION FOR DESIGN BUSINESSES

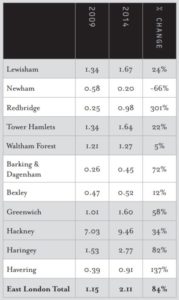

Analysis of location quotients (LQ) for design reveal that East London as a whole has an LQ of 2.11 – more than double the expected number (where 1 represents the national average density of designers in the working population).

Five East London boroughs combine high design LQs and high growth: Hackney, Haringey, Lewisham, Tower Hamlets and Greenwich. In all five, we observe increased employment in other fashion production and distribution sectors. Newham, whose growth is driven by fashion retail, is a clear outlier.

AS IT FACES DISRUPTION, LONDON MUST HARNESS FASHION-TECH TO A RANGE OF NEW PRODUCTS AND EXPERIENCES.

COMPETITIVE ADVANTAGE

London has the highest concentration of high value ‘convergent media’ businesses (with the greatest capacity for innovation and GVA growth) across a range of activities that are adjacent to and could have a direct bearing on future development of fashion, including: software development, ‘Internet of Things’, publishing, creative services, digital manufacturing, robotics, and music.

STRATEGIC INNOVATIONS IN THE AREA

Recent developments in both private and public sectors have contributed to organic growth of the sector in East London, which include knowledge assets in Tech City, MedCity, the City and Canary Wharf.

The landscape is changing with fashion retail and enterprise spaces at Hackney Walk and an accelerator for start-ups at Plexal, Here East based on the Queen Elizabeth Olympic Park.

Investment in specialist facilities for manufacturing and technology has resulted in Building Blocs in Enfield, Albion Knit in Haringaye and the Fashion Technology Academy at Fashion Enter.

Future development of East Bank on Stratford Waterfront will be the focal point of the Fashion District. This 73,600m2 cultural and educational hub is an £800 million public-private partnership, where fashion, technology, business and education meet.

It includes purpose-built campuses for London College of Fashion, UAL; University College London; the V&A; BBC; and Sadler’s Wells. It joins existing knowledge institutions in the Queen Elizabeth Olympic Park.

With the sector set for growth private and public sector investment will establish a studio campus at Fish Island Village in Hackney Wick run by social enterprise, The Trampery. Disused garages in Tower Hamlets will also be converted into manufacturing space, studios, and training space for fashion enterprises by housing association Poplar HARCA.

FUTURE DEVELOPMENT OF EAST BANK ON STRATFORD WATERFRONT WILL BE THE FOCAL POINT OF THE FASHION DISTRICT.

Key Findings

FASHION CONTRIBUTES OVER £1.4 BILLION IN GVA AND 36,000 JOBS TO THE ECONOMY OF EAST LONDON AND THE UPPER LEA VALLEY.

Analysis of the statistical base supported the perception of growth in East London’s fashion sector.

57% GVA INCREASE BEFORE INFLATION

Between 2010 and 2015, the direct economic contribution of the fashion sector to East London and Upper Lea Valley, measured by GVA, grew from £901 million to £1.417 billion per annum.

THE INNER EAST LONDON BOROUGHS OF HACKNEY, NEWHAM AND TOWER HAMLETS TOGETHER CONTRIBUTE 56% of East London and the Upper Lea Valley’s fashion output (£713m in 2015) and 16,000 jobs.

NEWHAM

Fastest growth in employment and GVA was in Newham, driven by the ‘Westfield factor’, which made it the borough with £251m GVA and 7,600 employment.

The fashion sector in East London and Upper Lea Valley has added 10,900 jobs between 2010 and 2015, from 25,300 to 36,200. That’s a 43% increase.

TOWER HAMLETS REMAINS THE BOROUGH WITH THE HIGHEST GVA AT £267M. 1,300 JOBS ADDED.

Between 2010 and 2015, employment in the three boroughs rose by 95 percent and GVA by 96 percent (including inflation). This represented 27% of the total growth in London’s fashion sector during the period.

In London, Fashion GVA and employment in East London and Upper Lea Valley rose nearly twice as fast as London’s fashion industry as a whole in the same period:

London fashion’s GVA grew by 29% from £4.363 billion to £5.644 billion London fashion’s employment grew by 22% from 131,300 to 159,700.

HACKNEY WAS THE NEXT FASTEST GROWING BOROUGH, WITH INCREASES IN £93M GVA AND 1,300 EMPLOYMENT.

THE THREE BOROUGHS TOGETHER REPRESENT 23% OF LONDON’S FASHION MANUFACTURING OUTPUT BY VALUE.

• There is a clear concentration of Specialist Design Services in East London

• There is evidence of strong manufacturing growth in the Upper Lea Valley. Despite its structural challenges, manufacturing is the fastest growing fashion sub-sector, with a 94% increase in employment and 128% increase in GVA between 2010 and 2015.

The majority of East London boroughs have a concentration of specialised design businesses.

Moving Forward

The table below show location quotients derived from BRES data for design employment in East London. Any score above 1 (marked here in grey) indicates a higher than average concentration of design-based businesses. We observe a pattern of increasing concentration of design business in most boroughs.

Hackney’s score of 9.46 is notable.

BASED ON THESE FINDINGS THE FASHION DISTRICT HAS CREATED AN ACTION PLAN THAT WILL INCREASE KNOWLEDGE EXCHANGE BETWEEN SECTORS, WHILE REDUCING STRUCTURAL BARRIERS TO GROWTH AND COORDINATION FAILURES WITHIN EAST LONDON’S FASHION SECTOR.

It will establish London as the world’s leading fashion-tech city, reclaiming East London’s place as a centre for fashion innovation, design, manufacture and retail. The action plan will find ways to accelerate fashion businesses in East London through networking, signposting, coordination, as well as developing space and targeted programmes to develop skills and support businesses at different stages of growth.

These findings are a summary of an independent report by BOP Consulting ‘East London Fashion Cluster, Strategy and Draft Action Plan’, delivered in 2017. Commissioned by London College of Fashion, UAL and the Mayor of London.